(Justin Vaughn, Editor, Options Trading Report)

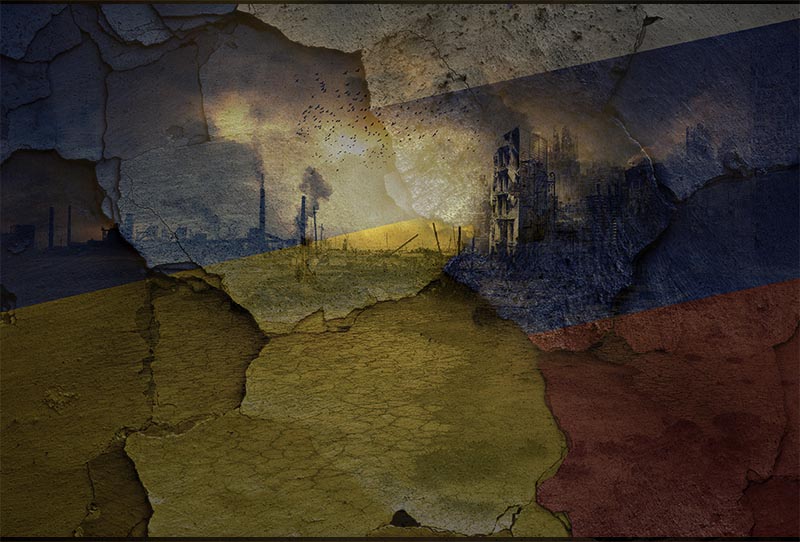

The Month Businesses Went To War… Businesses reacted as Putin invaded Ukraine. The invasion forced CEOs across the U.S. and Europe into a crisis mode. Massive bombing, and slaughtering of Ukraine citizens, unmercifully, prompted a giant response – never seen before, to the Russian economy. Two years after the pandemic tore into the global economy, another crisis emerged. The pandemic had given leaders a crisis playbook. Years of corporate activism on issues such as climate change, and racial discrimination had trained them to respond to a range of issues. The invasion took many by surprise but they reacted swiftly to what was a fatal threat to their employees and their businesses, and the country of Ukraine. When Putin launched his attack on February 24, and pressure from governments and employees began to build escalating sanctions on Russia, companies moved with unusual speed and with a sense of collective action. The result was corporate participation in geopolitics with little recent precedent. Sanctions the world has never seen, so compelling and so binding by a majority of American companies doing business in Russia. “I never believed that Putin would invade Ukraine. I never imagined there would be a war in Europe,” said Volkswagen AG CEO Herbert Diess. Within days of the invasion, Mr. Diess shut down or curtailed production of his biggest factories in Europe because the plants could not get wiring harnesses from Ukraine suppliers. All Russian manufacturing facilities were shut down in Russia citing its “great dismay and shock” over the invasion. More than 400 companies have since announced plans to suspend operations. They include American icons like McDonald’s, Coca-Cola, JPMorgan Chase, and hundreds more in banking and manufacturing and commerce. All credit card companies, such as Visa and Mastercard have ceased. Putin has reacted angrily with multiple threats to seize assets of companies that have fled. Lastly, Airbnb chairman, Brian Chesky announced that Airbnb would provide 100,000 stays to homeless Ukraine refugees. “In a world of darkness and destruction,” he said, “it was a reminder that kindness still exists.”

Stocks finished the week with strong gains…Major U.S. stocks indices powered higher, for best week since November 2020, recovering much of their lost ground. Oil prices stayed high, off from record highs of $130 a barrel, finishing the week near $100 a barrel. Investors have embraced Mr. Powell’s initial hike, and are more positive about the needs of the economy, and signs the Fed is in control. The weekly gains returned the S&P 500, the Dow Jones Industrial Average, and the tech-heavy Nasdaq Composite to positive territory for March, despite “the elevated commodity prices and geopolitical anxieties that have weighed on stocks recently,” said Karen Langley, writer, Wall Street Journal. The S&P 500 ended Friday with a gain of 6.2%, while the Dow Jones advanced 5.5%, and the tech-heavy Nasdaq climbed 8.3%. All three indexes recorded their best weekly -performance since the week ended November 2020. Big tech stocks clawed back some of their recent losses to help pull the market higher. Investors showed increased enthusiasm for U.S. stocks after several weeks of declines. They say the solid fundamentals of many U.S. companies will allow them to deliver profits in the face of higher costs and growing geopolitical uncertainty. Many believe the strong U.S. labor force will help consumers keep the economy growing. “The U.S. economy is on a really solid foundation right now, and it’s a key reason why the Fed is feeling comfortable in moving forward with their tightening process without potentially putting the U.S. in a recessionary type of environment,” said Jeff Schulze, Investment-strategist at ClearBridge Investments.

RUMBLINGS ON THE STREET

Ukraine President, Volodymyr Zelensky, speaking before Congress, Barron’s “I call on you to do more. New packages of sanctions are needed constantly, every week, until the Russian Military Machine stops.”

Randall W. Forsyth, lead writer, Up & Down Wall Street, Barron’s “If there’s one thing these economists do agree on, it’s that the Fed is unlikely to engineer a soft landing, reducing inflation without increasing unemployment or starting a recession. As the old Wall Street saying goes, “the four most dangerous words for investors are ‘This time it’s different.’ It probably won’t be.”

Louis Vincent-Gave, Co-founder, Gavekal Research, Barron’s “If Russia puts Ukraine to the sword, and the Western world effectively does nothing, China can say to Taiwan, ‘Ukraine was a sovereign nation. You’re just a renegade province that nobody recognizes. How convinced are you that the U.S. would back you? Come to the negotiating table, and let’s strike a deal.’ ”

Anh Lu, lead Portfolio Manager, T.Rowe Price New Asia, Barron’s “There are a lot of companies that can register very good growth for one or two years. But because they don’t have a sustainable way of running a business, they hit a wall, she says.”

THE NUMBERS – Barron’s

$500K – Price level topped on March 16 by Berkshire Hathaway’s A shares for the first time

40% – Percentage of Hong Kong population that isn’t vaccinated, 50% for those over 70

10.7 – Number of days a month Houston workers spend at the office. Some 85% of businesses have opened under hybrid plans.

$37K – Price of nickel per metric ton in London on Friday after a suspension and series of glitches, down from over $100,000 on March 8