Investors seeking a combination of both growth and income from their portfolio have a number of compelling investment categories to choose from. The most attractive of these categories is high growth dividend stocks.

High growth dividend stocks typically emerge from companies with strong fundamentals and a proven track record of performance. This allows for the powerful combination of capital appreciation plus regular dividend income.

In addition, many high growth dividend stocks are in sectors that have been shown to hold up well during times of economic uncertainty, meaning they can help reduce your portfolio’s overall volatility.

In fact, recent research has shown that companies offering steady, sustainable dividends – without going overboard on payouts – have provided the best returns over time.[1]

As investors look to identify stocks that pay high dividends, they typically look at the dividend yield. This ratio shows how much a company pays out in dividends each year in relation to its stock price.

So, for example, if a company pays $1 in annualized dividends and its share price is $20, then its dividend yield would be 5%. This metric is especially useful to help judge if the company is paying a higher or lower dividend than it has previously in relation to its share price. What follows is a list of the five best-positioned high growth dividend stocks for your consideration. As always, be sure to do your own due diligence before investing in any stock to make sure it’s right for your financial situation and that it is consistent with your acceptable level of risk.

High Growth Dividend Stock #1: McDonald’s Corporation (NYSE: MCD)

McDonald’s Corporation (NYSE: MCD) is a U.S.-based multinational restaurant chain that serves hamburgers, fries, chicken sandwiches and drinks. The company is the largest restaurant chain by revenue and serves more than 69 million customers daily. Total revenue topped $23 billion in 2022, with most revenue coming from its franchisees. The company operates in 100 countries and is the world’s second-largest private employer, with more than 200,000 executives, managers, cooks and front-line staff. McDonald’s has raised its annual dividend payout for 47 consecutive years, including a 9.9% payout increase for its final 2023 payout.

The company is currently paying out a quarterly dividend of $1.67 per share, with an annual dividend yield of 2.54%

Over the past five years, the company’s dividend growth is measured at 8.3% annualized, and Morningstar expects the dividend to grow at a low double-digit pace over the next three years.

McDonald’s Corporation has received a consensus rating of Strong Buy based on recommendations from 34 from analysts, according to Nasdaq.com with a consensus share price target of $311.79 as of this writing.[2]

High Growth Dividend Stock #2: Exxon Mobil Corporation (NYSE: XOM)

Exxon Mobil Corp. (NYSE: XOM) engages in the exploration, development, and distribution of oil, gas, and petroleum products. It is the largest energy company in the United States.

In terms of its operations, Exxon Mobil is the world’s second-largest oil refiner and the largest refiner outside of China. In terms of reserves, ExxonMobil claimed about 18.5 million barrels of oil and oil equivalents at the end of 2021 and was ranked 15th globally.

Exxon Mobil is currently paying out a quarterly dividend of $0.95 per share, with an annual dividend yield of 3.39% compared to the Oil and Gas – Integrated – International industry’s yield of 2.85% and the S&P 500’s yield of 1.58%.

Over the past five years, the company’s dividend growth rate has been recorded at 2.20% per year. In addition, during that span, the company has increased its dividend four times on a year-over-year basis. Exxon Mobil has received a consensus rating of Strong Buy based on recommendations from 22 analysts, according to Nasdaq.com, with a consensus price target of $136.87 as of this writing.[3]

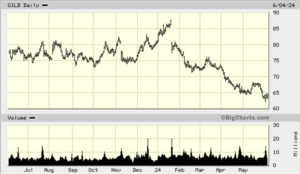

High Growth Dividend Stock #3: Gilead Sciences, Inc. (Nasdaq: GILD)

Gilead Sciences, Inc. (Nasdaq: GILD) is a leading biopharmaceutical company in Foster City, California. Founded in 1987, the company focuses on discovering, developing, and commercializing therapies in HIV/AIDS, liver diseases, oncology, inflammatory and respiratory diseases, and cardiovascular conditions.

Gilead’s portfolio includes a wide range of products and therapies, with its most notable product being Truvada, a leading medication for HIV prevention. The company also offers other HIV treatments, such as Biktarvy and Descovy. In addition to its HIV franchise, Gilead has significantly advanced in treating chronic hepatitis B and C with drugs like Veklury and Epclusa. Furthermore, the company has expanded into oncology with therapies such as Trodelvy and Yescarta.

Gilead Sciences is currently paying out a quarterly dividend of $0.77 per share, with an annual dividend yield of 4.80%.

Over the past five years, the company’s dividend growth rate has been recorded at 5.23% per year. In addition, the company has increased its dividend for the past nine consecutive years.

High Growth Dividend Stock #4: Target Corporation (NYSE: TGT)

Target Corporation (NYSE: TGT) is now the seventh largest retailer in the United States and is projected to bring in more than $113 billion in revenue for fiscal 2023.

The company listed about 2,000 stores in mid-2022 and had plans for growth. The company sells its products through a chain of stores as well as eCommerce. eCommerce is about 20% of Target’s total revenue and was boosted by the COVID-19 pandemic.

Target Corporation is currently paying out a quarterly dividend of $1.10 per share, with an annual dividend yield of 2.92%. The company’s second quarter dividend – payable June 10, 2024 – will be Target Corp.’s 227th consecutive dividend paid since October 1967 when the company became publicly held.

Over the past five years, the company’s dividend growth rate has been recorded at 11.59% per year. In addition, the company has now increased its dividends for 52 consecutive years.

According to Zacks Investment Research, of 33 recorded analyst ratings, Target Corporation has received 18 Strong Buy ratings, 4 Buy ratings and 10 Hold ratings with an average price target of $175.21 per share as of this writing, which represents an upside of 18.91% from the current price.[4]

High Growth Dividend Stock #5: Pfizer Inc. (NYSE: PFE)

Pfizer Inc. (NYSE: PFE) is a US-based multinational biotech company. The company operates as a research-based pharmaceutical company focused on the discovery, production and marketing of medicines and vaccines. It is the 2nd largest drugmaker globally by revenue and is ranked 64th on the Fortune 500 list. The company’s avenues of research include Immunology, Oncology, Cardiology, Endocrinology and Neurology and the company has at least ten blockbuster drugs producing more than $1 billion in avenue revenue each.

Pfizer Inc. is currently paying out a quarterly dividend of $0.42 per share, with an annual dividend yield of 5.70%. The first quarter 2024 cash dividend – paid on March 1, 2024 – was the 341st consecutive quarterly dividend paid by Pfizer.

Over the past five years, the company’s dividend growth rate has been recorded at 3.64% per year. In addition, the company has now increased its dividends for 15 consecutive years.